A beneficiary designation is the act of naming someone to receive money, property, investments, or any other specific benefit from your estate.

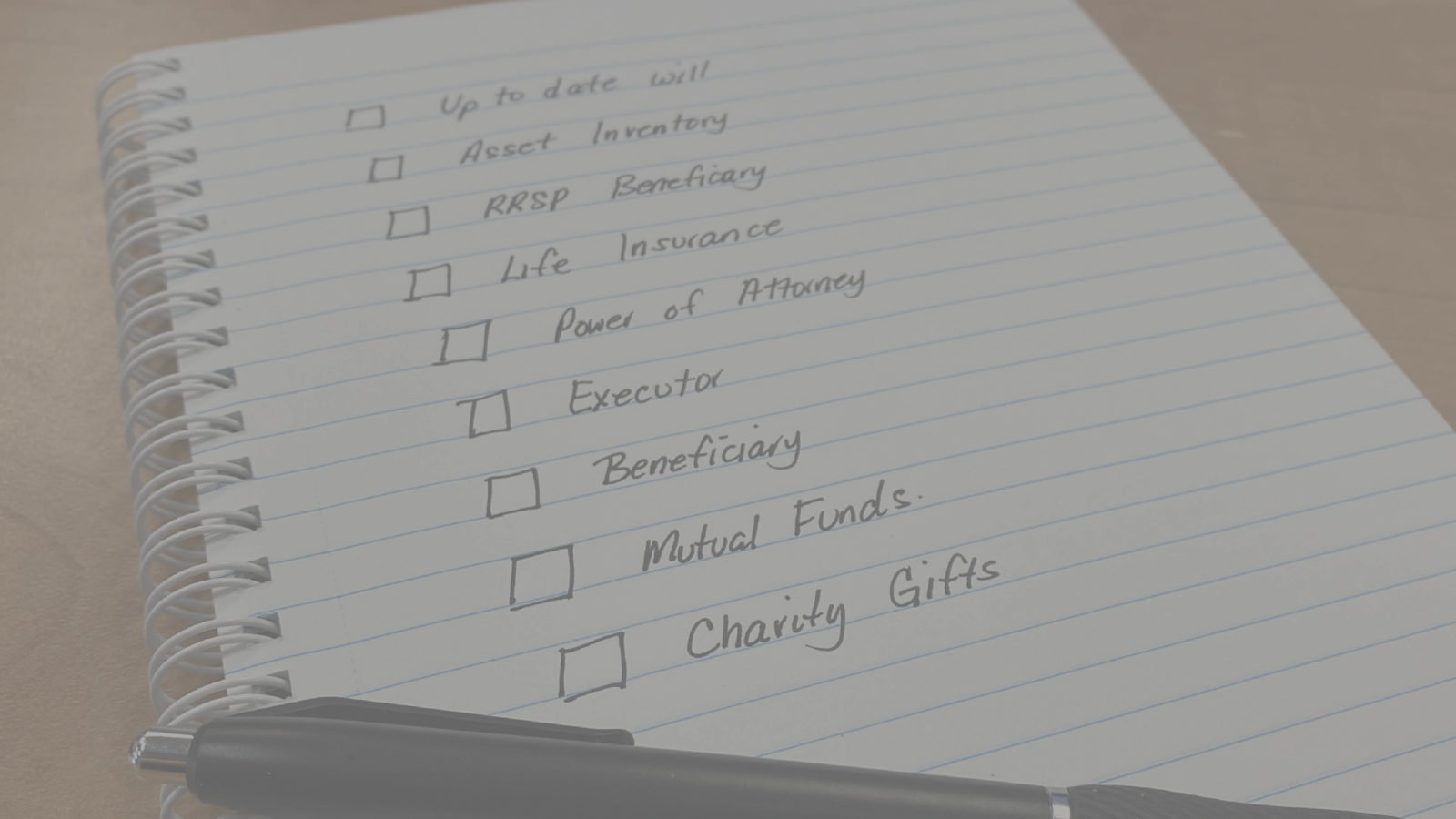

There are various types of beneficiary designations than can be made. Beneficiaries can be named in your Will, on a Life Insurance Policy, on a Registered Retirement Savings Plan (RRSP), Tax-free Savings Account (TFSA) and on a Registered Retirement Income Plan (RRIF).

There are also primary and contingent beneficiary designations. When leaving your estate to a single person, the person who you consider to be first-in-line would be the primary beneficiary.

But what happens if your primary beneficiary passes away before you do? That’s where the contingent beneficiary is important. This would be the person you consider to be second-in-line.

In the cases where no named beneficiary has been designated the assets become part of the estate.

After you pass away, your Will will likely be submitted to the court to go through the probate process. This is process in which the court confirms the validity of your Will and authorizes your executor to start acting as your executor. As part of the probate process, your estate is subject to probate fees.

Assets that have beneficiary designations are considered to be outside of your estate. The significance of being outside of the estate is these assets are not subject to probate fees. The beneficiary that is named on assets such as Life Insurance Policies, RRSPs, RRIF will receive the proceeds of those assets directly from the institution.

There are still tax implications on RRSPs and RRIFs, even if they are outside of your estate. They are considered to be income in the year of your passing. As the institutions deduct income tax directly from the value of the RRSP and RRIF the beneficiary does not receive the full Fair Market Value. For more on RRSP and RRIF click here.

If a beneficiary is not named on your Life Insurance, RRSP or RRIF or your estate is named as beneficiary then those assets become part of your estate and the value of those assets will be subject to probate fees.

It is important to name beneficiaries to reduce the amount of probate fees that your estate may be subject to.