estate planning is essential

Canadians know estate planning is important but the numbers may surprise you.

Canadian estate planning by the numbers*

91%

of Canadians think Wills are an important component of an estate plan.

74%

of Canadians aged 55 years and older say they have a Will.

30%

of Canadians aged 18–34 years have a Will.

43%

of 18 – 34 year old Canadians believe they need to reach a certain age to put a Will in place.

48%

of Canadians say they have a Will.

34%

of Canadians aged 35–54 years have a Will

25%

of Canadians don’t know where to begin Will preparation or Estate Planning

Many

Canadians think they need to own assets of significant value or complexity to have an estate plan.

*Survey conducted by RBC Wealth Management

Planned & Legacy Giving components are important pieces of a balanced, strategic Estate Plan

You may have many causes to which you donate throughout your lifetime to help charities, such as Global Aid Network, with funding their mission and you desire to continue to support them in the future. This is where Planned and Legacy Giving comes in.

Strategic and detailed Planned and Legacy Giving helps you to continue to support your family, causes and charities you are passionate about even after you are gone. It will also help avoid the burden of probate for your loved ones, which can be a costly and complicated process.

Planned Giving is a little different from day-to-day donations, which are the answer to the question, “How can I help today?” Planned and Legacy Gifts answers two different questions, “How can I help tomorrow?” and “How would I like to be remembered?” Planned Giving, as the name suggests, are the plans that are set in place to support the causes and charities you are passionate about.

A Legacy Gift is a gift to a charity or non-profit organization in your will. Gifts can take various forms including real estate, a specific cash amounts, or a percentage of your estate. Legacy Gifts are a part of your Planned Giving strategy and they play a key role in supporting charitable organizations and reducing the tax burden on your estate. You may not know that they are an option, how they are paid out or the specific tax benefits of these gifts (immediate deductions and/or exemptions and estate tax exemptions).

While Legacy Giving makes it possible to leave much larger gifts than otherwise possible. Legacy Gifts can be small or large – there is no gift too small to make an impact. It only takes a few minutes to leave a gift to a charity but it creates a legacy that lives on forever while still allowing you to provide for loved ones.

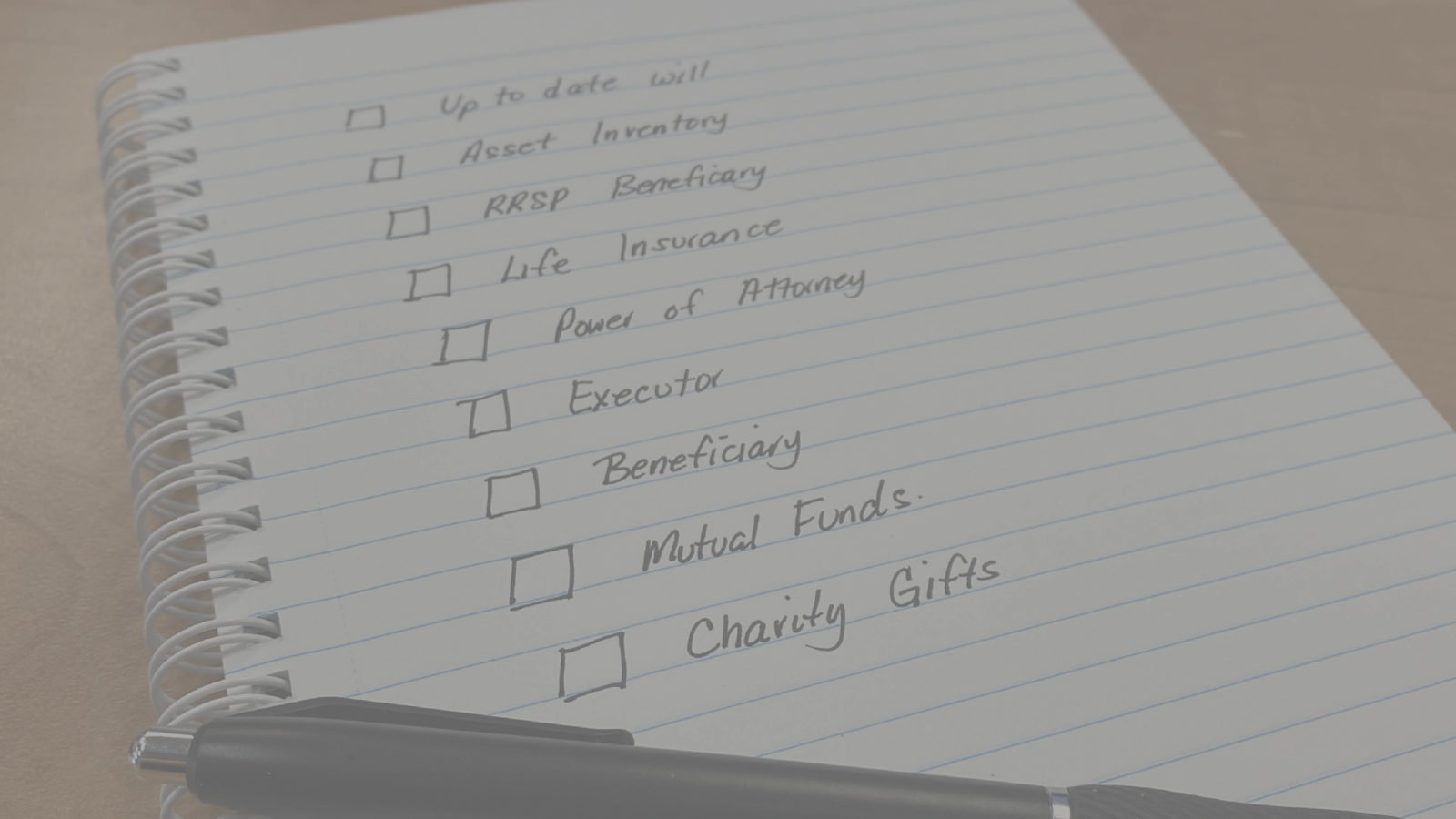

Wills

A Will, or a Last Will and Testament, is a legal document that describes how you would like your property and other assets to be distributed after your death. When you make a Will, you can also use it to nominate guardians for your children, dependents, or pets.

From your estate, you can choose to leave specific gifts to individuals, as well as legacy donations to charities and organizations that are close to your heart. Anything left over is called your ‘residual estate,’ or simply ‘the residue.’ The most current version of your will, if executed wholly and correctly, should override previous versions of your will or verbal agreements you may have made during your lifetime.

A Will can be a very simple document or one that is complex and contains codicils. A codicil is a Will amendment, a statement that adds to or changes the Will in some way without having to rewrite the entire Will.

Donor Advised Funds

A Donor Advised Fund is a charitable giving vehicle, much like a charitable foundation. Many families use Donor Advised Funds to create family foundations. The Fund is established initially through an up-front donation by a donor to an independent organization, like Link Charity. A single donor (or multiple donors) can contribute to the fund as frequently as they like and watch as their charity’s investment grows tax-free.

Donors to the fund receive immediate tax benefits and can advise on fund distribution to their favourite charities at any time.

Charitable Gift Annuites

A Charitable Gift Annuity is an arrangement which transfers assets from an individual to a non-profit organization. The annuitant (donor or individual) then receives a regular payment for life based on the value of assets transferred to the organization. The full value of the Charitable Gift is deferred as long as the annuitant is receiving income. Once the annuitant is no longer receiving income the value of the remaining annuity is transferred to the charity.

The annuities simultaneously provide a charitable donation, a partial income tax deduction for the donation, and a guaranteed lifetime income stream to the annuitant and sometimes a spouse or other beneficiary.

Gift of Securities

A Security is a financial investment with a monetary value. It entitles the holder to ownership of a part of a publicly traded company. A security can be a stock or a debt obligation, such as a bond.

The Gift of Security is the donation of a security (stock, bond or mutual fund) to a charity. Gifting a Security is often referred to as a “gift in-kind”, meaning it is a non-cash donation.

Beneficiary Designations – Beneficiary designations allow you to transfer assets directly to individuals, regardless of the terms of your will. Beneficiary designations are made when a financial account, retirement account, or life insurance policy is established.

Probate and estate taxes can be offset through beneficiary designation to charitable organization AND while still providing for loved ones.

Gift-in-Kind

A Gift-in-Kind is a voluntary transfer of property, goods or services where the giver does not receive a product, service or payment in exchange.

When the recipient of the Gift-in-kind is a charity the giver receives a charitable receipt for the fair market value of the item.

Gifts can include: Real Estate (home, cottage, bare land), personal items (hygiene products, new furniture, etc), equipment or food.

Beneficiary Designation

Beneficiary designations allow you to transfer assets directly to individuals, regardless of the terms of your will. Beneficiary designations are made when a financial account, retirement account, or life insurance policy is established.

Probate and estate taxes can be offset through beneficiary designation to charitable organization AND while still providing for loved ones.

RRSP / RRIF

An essential part of financial planning in Canada includes preparation and planning for retirement. Registered Retirement Savings and Registered Retirement Income Plans are an important part of this planning.

Registered Retirement Savings Plan (RRSP)

An RRSP is a government registered savings plan that an individual establishes and contributes into up to the age of 65.

Contributions to the RRSP can be made by the account owner or their spouse or common-law partner. Eligible deductible RRSP contributions can be used to reduce income taxes.

Registered Retirement Income Fund (RRIF)

An RRIF is an arrangement between an individual and a carrier (an insurance company, a trust company or a bank) that is registered with the Canadian Government. In principle it is similar to a Guaranteed Investment Certificate (GIC). One are where it differs is in the funding. GIC’s are funded with after-tax dollars, whereas RRIF’s are funding with pre-tax dollars.

Letter of Direction

A letter of direction is a document that provides instruction and guidance to a recipient. Letters of Direction are used in various situations such as instructions to financial institutions to transfer funds (commonly used with the sale and purchase of real estate), and in the execution of a Will documenting the executors proof of control in regards to the deceased’s estate. Additionally, they can be written to give a financial broker power of attorney over an investment account.

Letters of Direction accompany a Will providing more specific direction regarding the disbursement of the Estate, they are not a replacement or alternative to a Will.

Charitable Loan Agreement

In structure a Charitable Loan Agreement is similar to a Guaranteed Investment Contract (GIC).

In simplified terms a loan is made between you and a third-party charitable organization, such as Link Charity. Then Link Charity put the funds in an investment pool.

-

Water for Life Initiative

-

Local Church Partnership

-

Economic Empowerment

-

Disaster Relief and Preparedness

Water is essential to life. It’s a basic human necessity. Yet, almost 1 in 9 people on the planet right now still don’t have access to safe water.

We believe it’s possible to see a world where physical, spiritual, social and economic brokenness is restored.

We have found that long-lasting impact in each community is only made possible through the local church. It permeates throughout everything we do.

It is possible for women and young girls to thrive and experience the fullness of life that God intends for them, even when they experience poverty, unemployment, and lack of economic opportunities.

When drought hits and famine devastates communities, when injustice and corruption exploit people living in poverty, when a hurricane tears through and shatters everything, when people are displaced and lose their homes, when violence destroys livelihoods and inflicts suffering…people need hope.

GAiN has partnered with Link Charity to better assist our donors with the ability to answer the question, “How can I help GAiN in the future?”

Link Charity makes donating to GAiN easy with the help of their knowledgeable financial experts and wide variety of Planned Gifting options.

Link Charity provides an easy and cost effective process for donating stocks and mutual funds, estate gifts, RRSP/RRIFs, and much more. Their team works hard to strategically save you hundreds of dollars in brokerage fees and capital gains, while at the same time supporting the charities of your choice.

Whether you want to remain anonymous or have your donation known, they can help you save thousands of dollars in taxes – both now and at estate time.

INTERESTED IN LEARNING

MORE?

There is not “one-size fits all” when it comes to Planned & Legacy Giving. Link Charity and your estate planning professional can assist you to design a plan that will suit your desires relating to Planning & Legacy Giving and how best to meet your philanthropic needs.

For more information about GAiN’s Planned Giving Program contact us at plg@globalaid.net